Official Pre-COP Opening Ceremony. Photo: Rafa Neddermeyer/COP30 Brasil Amazônia/PR

With the new USD 1.3 trillion-a-year global climate finance goal now on the table, attention is shifting from targets to delivery, from how much finance the world can mobilize to how effectively it can be delivered and where it will go. And at the center of that question lies one of the world’s most powerful yet underfunded solutions: forests.

At the final Belém Desk media briefing before COP30, experts from government, civil society, and the private sector came together to explore how the next climate summit could finally make finance flow for forests and nature. Their message was clear: forest finance isn’t a side issue — it’s the foundation on which climate ambition will stand or fall.

Read more

Related articles for further reading

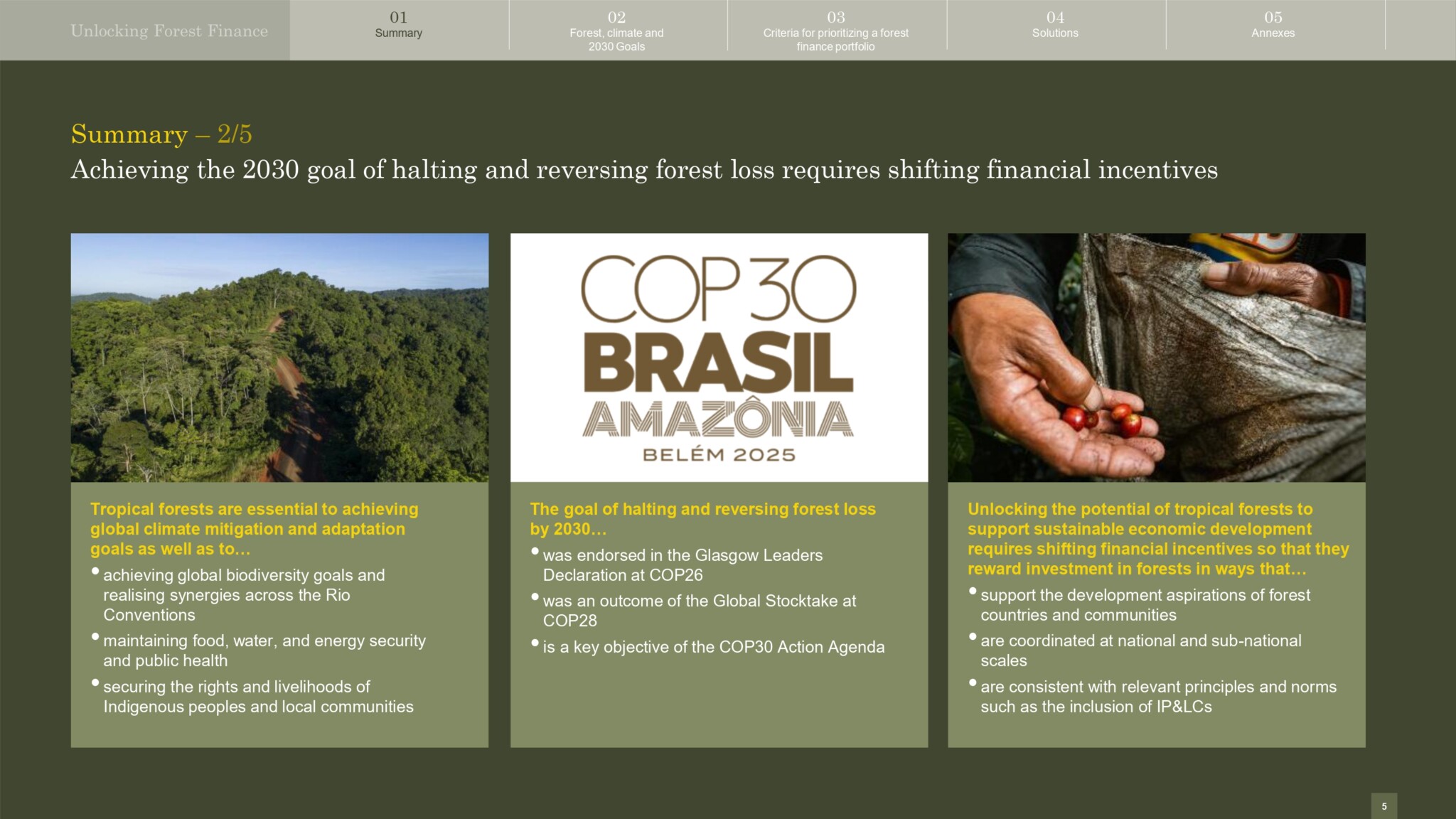

From Pledges to Pathways

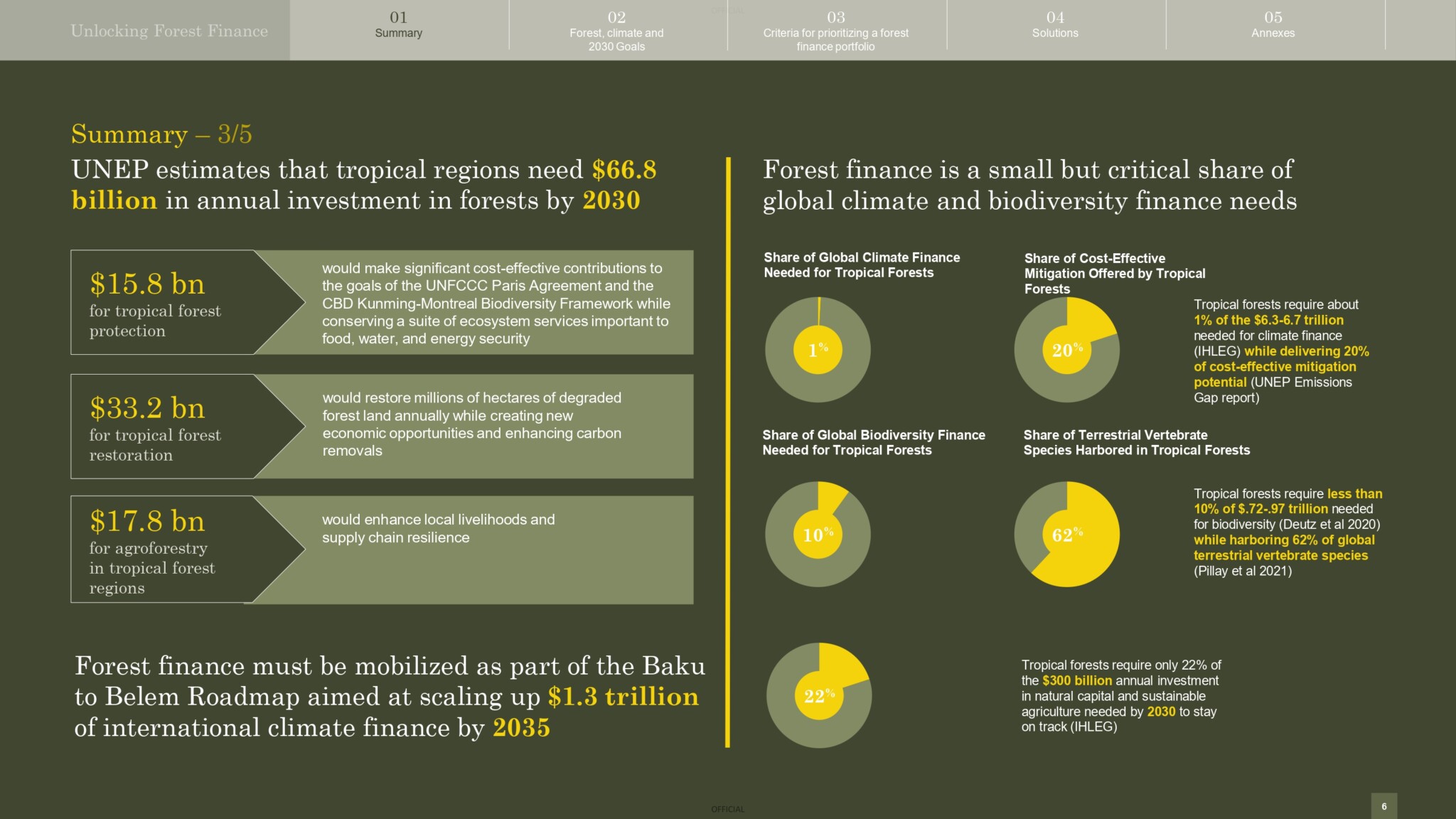

Tropical forests absorb carbon, regulate rainfall, and sustain biodiversity — yet they receive barely 1% of global climate finance, even though they could deliver up to 20% of global mitigation potential. As the UNEP’s latest data show, tropical regions alone need around USD 67 billion annually by 2030 to stay on track for climate and biodiversity goals.

“We’re not short of pledges — we’re short of pathways,” said Frances Seymour, Senior Policy Advisor at the Woodwell Climate Research Center, opening the session. “The Forest Finance Roadmap is designed to turn those pledges into practice.”

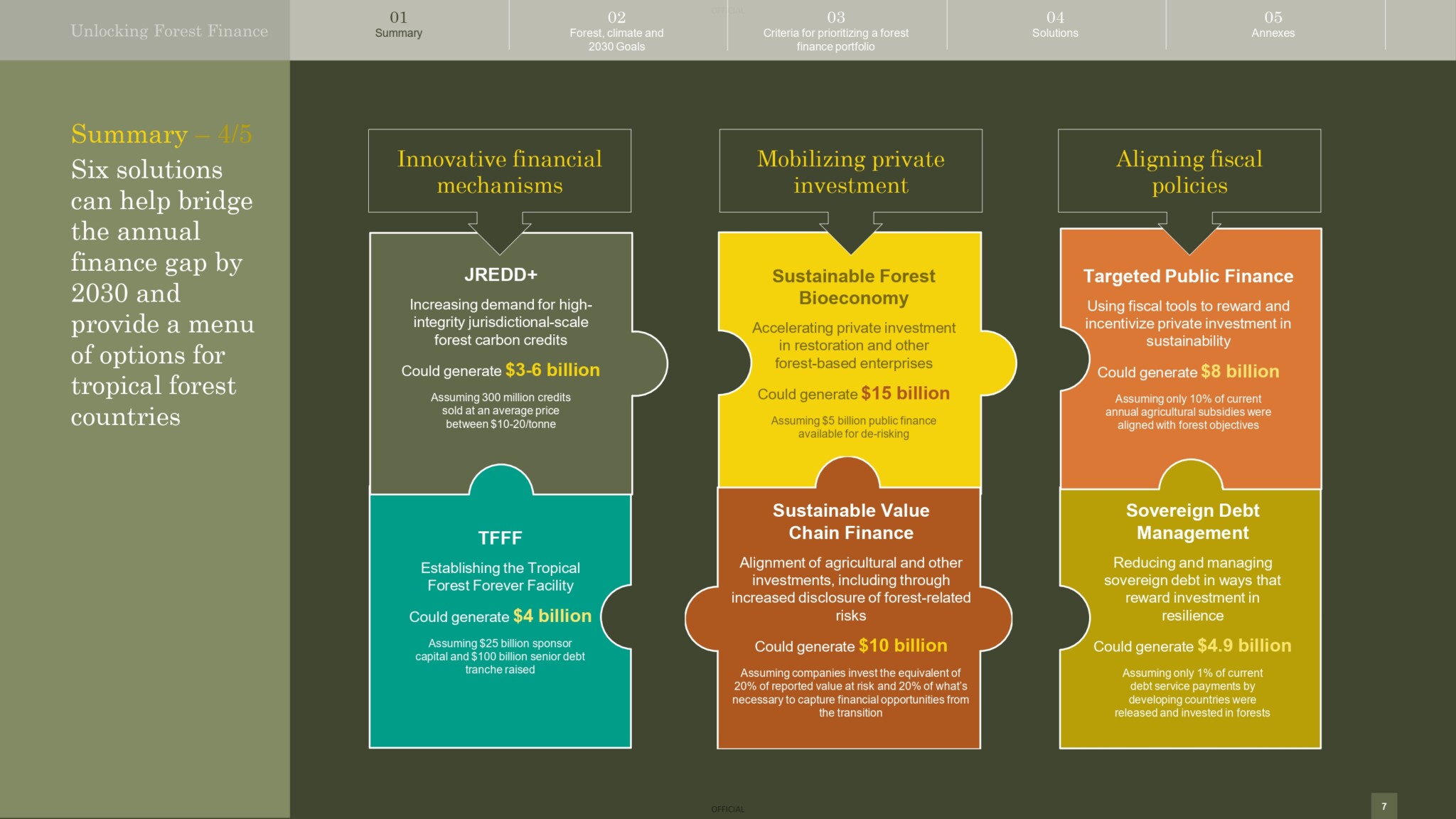

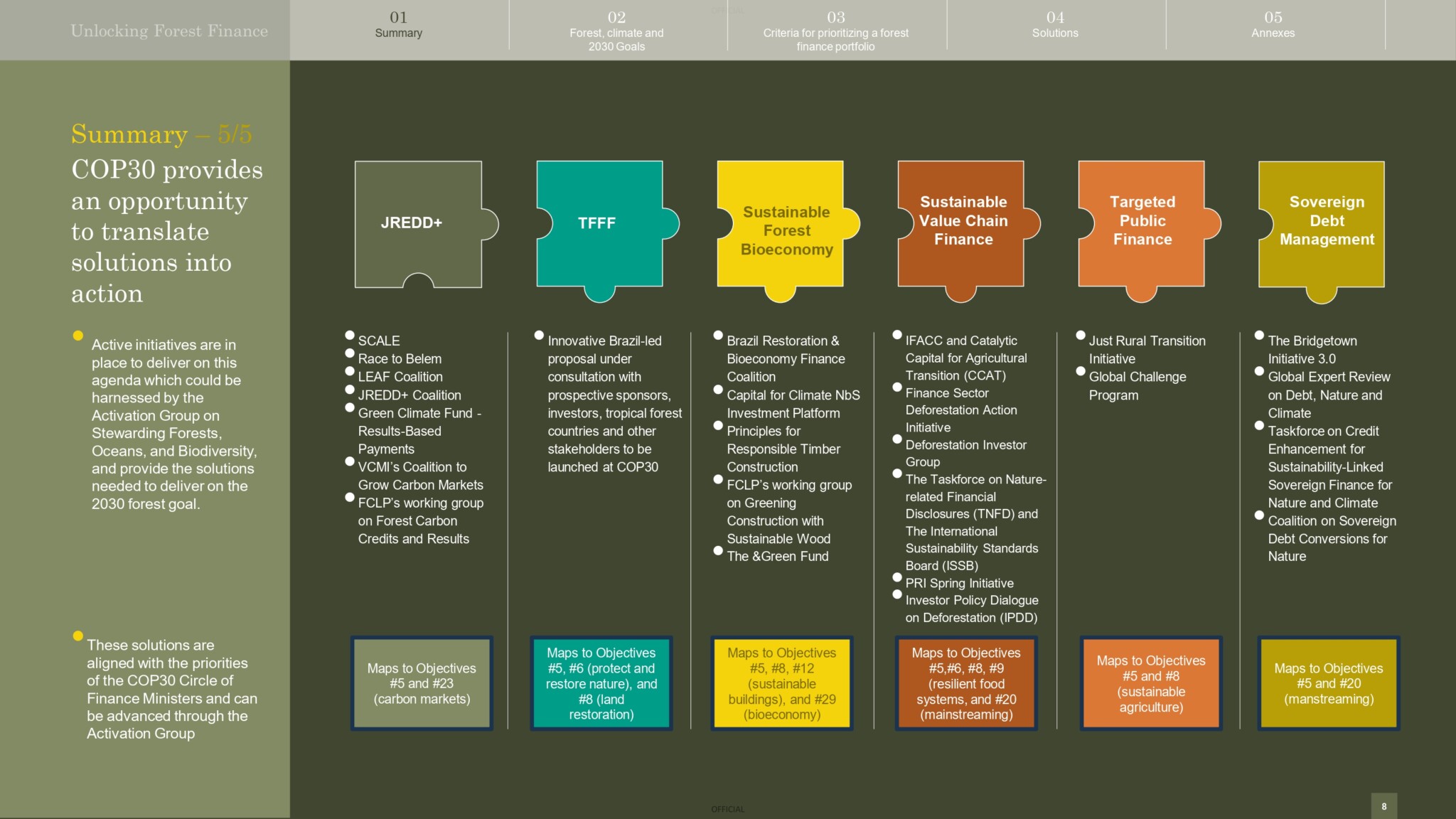

Developed through the Forest Climate Leaders Partnership (FCLP) in collaboration with Brazil and UNEP, the Roadmap sets out six complementary pathways to close the USD 67 billion annual forest finance gap identified by UNEP. These include jurisdictional REDD+, the Tropical Forests Forever Facility (TFFF), and investments in the forest bioeconomy, alongside supply-chain reforms, fiscal alignment, and sovereign-debt instruments that reward forest resilience.

“The Roadmap brings the Global North and South together around one vision — not charity, but shared investment in the world’s natural capital,” Seymour added. “Belém can be the moment when we stop talking about the finance gap and start closing it.”

Frances Seymour, Senior Policy Advisor at the Woodwell Climate Research Center.

A Permanent Facility for Standing Forests

One of the most closely watched of those emerging mechanisms is the Tropical Forests Forever Facility (TFFF) – Brazil’s flagship finance initiative for COP30.

“The TFFF rewards countries for keeping forests standing, not for what they cut or emit, but for what they conserve,” said André Aquino, Special Advisor for Economy and Environment at Brazil’s Ministry of Environment. “We’re creating a long-term, predictable mechanism that complements carbon markets rather than competes with them.”

Aquino announced that the World Bank has been confirmed as the interim host for the Facility, with the official launch of the facility set for November 6th, marking a major step toward operationalizing it. “This is not a pilot; it’s a permanent instrument,” he said. “It’s about building lasting confidence in forest finance.”

With Brazil pledging USD 1 billion in seed capital, the government is now working to mobilize additional donor contributions ahead of COP30, with the goal of eventually generating up to USD 4 billion annually for forest conservation. Importantly, at least 20% of funds will go directly to Indigenous Peoples and local communities — a long-awaited step toward direct access to finance.

“They are not beneficiaries — they are co-investors in our planet’s stability,” Aquino emphasized.

TFFF complements carbon markets by rewarding forest area rather than emissions reductions — expanding the toolbox for countries protecting forests.”And that doesn’t mean one is better than the other. On the contrary, the bet is on complementarity.

Decades in the Making, Ready to Scale

For Eron Bloomgarden, founder and CEO of Emergent, the next phase of forest finance is about scale — and trust. “Jurisdictional REDD+ has taken decades to form and perfect,” he said. “It’s been tested, refined, and is now ready to scale.”

Bloomgarden pointed to the LEAF Coalition, which has already mobilized more than USD 1 billion in public and private commitments for high-integrity jurisdictional credits, as proof that the private sector is ready to engage when clear standards are in place.

“TFFF and Jurisdictional REDD+ aren’t rivals — they’re complementary,” he added. “One pays for hectares of forest; the other for verified tonnes of avoided emissions. Together, they deliver more.”

Eron Bloomgarden, founder and CEO of Emergent

The next step, he said, is policy alignment — including recognition of jurisdictional credits under Article 6 of the Paris Agreement, which could “provide the rocket fuel to take forest finance to the next level.”

Bioeconomy: Turning Value into Vision

If finance mechanisms define how money flows, the bioeconomy defines where it goes — toward transforming natural capital into sustainable prosperity.

“The bioeconomy is not a side story — it’s the next phase of the global economy.”

Julie McCarthy, CEO of NatureFinance.

“We can’t build a sustainable economy on an unsustainable foundation. The bioeconomy is how we reconcile growth with planetary health”, said Julie McCarthy, CEO of NatureFinance.

Globally valued at USD 4–5 trillion and projected to reach USD 30 trillion by 2050, the bioeconomy represents a fundamental shift: from exploiting nature to investing in its regeneration.

At COP30, Brazil will launch its Bioeconomy Challenge, a partnership between NatureFinance and the Ministry of Environment, designed to operationalize the G20 High-Level Principles on Bioeconomy through shared metrics, de-risking instruments, and market development.

“The Bioeconomy isn’t just environmental policy; it’s essential economic infrastructure for the 21st century,” said Carina Pimenta, Brazil’s National Secretary for the Bioeconomy. “We want to show that development in the Amazon and other biomes can be based on standing forests, on local knowledge, and on cultural diversity.”

“This is not only about products, but about people — especially Indigenous and traditional communities who are the true innovators of the forest economy,” she added.

What to watch out for at COP30

Photo: COP30 Presidency

As COP30 approaches, several developments are expected to dominate the forest finance agenda in Belém:

- The official launch of the Tropical Forests Forever Facility, including new donor and country pledges.

- Expansion of the LEAF Coalition with new jurisdictional agreements and private-sector participants.

- The launch of Brazil’s Bioeconomy Challenge, setting a model for inclusive, forest-based growth.

- Launch of the “Earth Investment Engine”, aligning multilateral banks and funds around nature-based climate solutions.

These steps, if achieved, could signal a pivotal shift: from fragmented projects and pilot programs to a coherent global system that rewards the value of standing forests.

Beyond Belém

As the first COP ever hosted in the Amazon, COP30 is a symbolic and strategic moment for the world to confront how climate and nature finance are intertwined.

In Frances Seymour’s words: “The needs are clear, the solutions are available — what we need now are champions to turn them into action.”

If the mechanisms now emerging — from TFFF and jurisdictional REDD+ to the bioeconomy — come together in Brazil, they could transform not just how much finance flows, but how wisely it’s invested.

That, ultimately, could be the real trillion-dollar breakthrough.