New nature-tech

Moving into a more nature-rich world also heralds as yet untapped opportunities for the ‘Nature Tech’ sector. While this sector is currently small compared to the global market for low-carbon and environmental goods and services (estimated by the OECD to be worth $5.5 trillion and growing at over 3% per year), there are signs that a wave of new enterprise is on its way.

- Today, we are seeing the contours of a ‘fourth agricultural revolution.’ Exciting innovations are emerging, which could reshape food and land use systems over the coming decade. Precision agriculture (and aquaculture), guided by big data and using robotics, gene-editing and powerful remote sensing devices, could unlock significant improvements in crop yields and nutritional content, improve crop resilience and increase livestock productivity while reducing agriculture’s environmental footprint. These trends have the potential to scale quickly (although from a low base—in 2017, $16.9 billion of venture capital finance flowed into new food and ag-tech companies, five times the flow in 2012).[1] In parallel, regenerative approaches—no-till farming, winter crops, intercropping, agroforestry—are evolving and gaining traction.[2]

- By asking how the tech industry can accelerate and help progress the rapid deployment of nature-based solutions, it is not a huge leap to imagine what impact emerging technologies will have over the next decade— including artificial intelligence and machine learning, data-driven storytelling and design-thinking. These have the potential to deliver more efficient and effective path to conservation, management of ecosystems services and reduction in the impact of complex supply chains. → For example, recently, Planet Labs, who specialize in real-time high-definition satellite monitoring, was valued at over $1 billion. This represents the interest in companies’ investment in their supply chain monitoring.

- For example, Nestlé as part of its ‘No Deforestation’ commitment, is implementing 100% satellite monitoring coverage of its global palm oil supply chains.

- Significant investment in human capital, technology diffusion and the digital revolution would support the emergence of a new generation of young ‘nature tech’ entrepreneurs able to take advantage of the opportunities offered by the transformation of a nature-positive recovery. This presents an opportunity for more highly skilled jobs and the prospect of innovation, research and development, much of which would have strong connection to the rural economy.

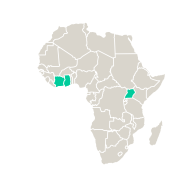

Africa

Uganda

In Uganda, TechnoServe partnered with the Bill and Melinda Gates Foundation to pilot the use of drones in monitoring and optimizing agricultural interventions to improve practices, yields, and incomes. Through the partnership, TechnoServe helped seed company Equator Seeds to monitor the farming practices of their 30,000 contractor smallholder farmers.

The pilot delivered significant benefits for both farmers and Equator Seeds in increased yields and decreased input costs. Pesticide use declined by 60%, and there was an average $2,150 increase in annual profits for the 270 pilot farms. Equator Seeds gained profits of $6.5 million, delivering a return of $20 for each $1 of program investment.

A projected 100% increase in yields, coupled with the reduced spending on pesticides, means the 30,000 individual farmers in Equator Seeds’ sourcing network can expect returns of over $3,000 and $1,500 in their first year of maize and soy seed production, respectively. This would equate to a $67 million increase in smallholder farmers’ income and $300 million to Equator Seeds’ profits in just one year.[3]

Ghana and Côte d’Ivoire

The cocoa sector, centred on Ghana and Côte d’Ivoire, is particularly sensitive to climate change-related disruption. In Ghana, lack of adaptation is predicted to create income losses to cocoa farmers of up to $410 million a year. Companies along the value chain, therefore, have targeted the region for tech-driven, sustainable intensification projects to address productivity challenges, deforestation and requirements for better livelihoods and working conditions.

A concern is the lack of easily accessible and accurate weather data. An estimated 1.5 million farming households in key growing areas in West Africa cannot make data- driven agricultural management decisions. The CocoaCloud project, led by the World Business Council for Sustainable Development and Outputs Insights BV, seeks to fill this knowledge gap with a five-year pre-competitive data platform.

Data is collected from ground sensors across the region. CocoaCloud sends local weather forecasts and farm management alerts based on agronomic algorithms and location data. The platform also allows exchanges of knowledge and feedback between farmers and extension services. Today, CocoaCloud supports 7,500 cocoa farmers, community members and extension workers in Ghana’s Western Region. The target is to make data available for more than 1 million smallholder farmers in Ghana and Cote d’Ivoire by 2024.[4]

Resources

[1] AgFunder Tech Investing Report 2018 (2018)

[2] FOLU Growing Better Global Report (2019)

[3] The Global Commission on the Economy and Climate, Seizing the Global Opportunity (2015)

[4] FOLU Growing Better Global Report (2019)