The panel was moderated by Giulia Carbone, Director of the Natural Climate Solutions Alliance. Photo: Mariana Ceccon/Nature4Climate

Read more

Related articles for further reading

WRAPPING-UP

+ The distinction between buying and investing needs to be clarified for nature-based solutions in the voluntary carbon market.

+ Corporates need clarity over the future eligibility of nature-based carbon credits to meet emission reduction targets.

+ To ensure a trusted supply of high-quality credits, more corporates wish to involve themselves in the design and implementation of nature-based projects.

On 26th June, the Nature4Climate coalition gathered a panel of corporate investors to discuss hesitation and nature-based carbon credits. Moderated by Giulia Carbone of WBCSD, the four panellists candidly shared their experiences of investing and buying in the voluntary carbon market.

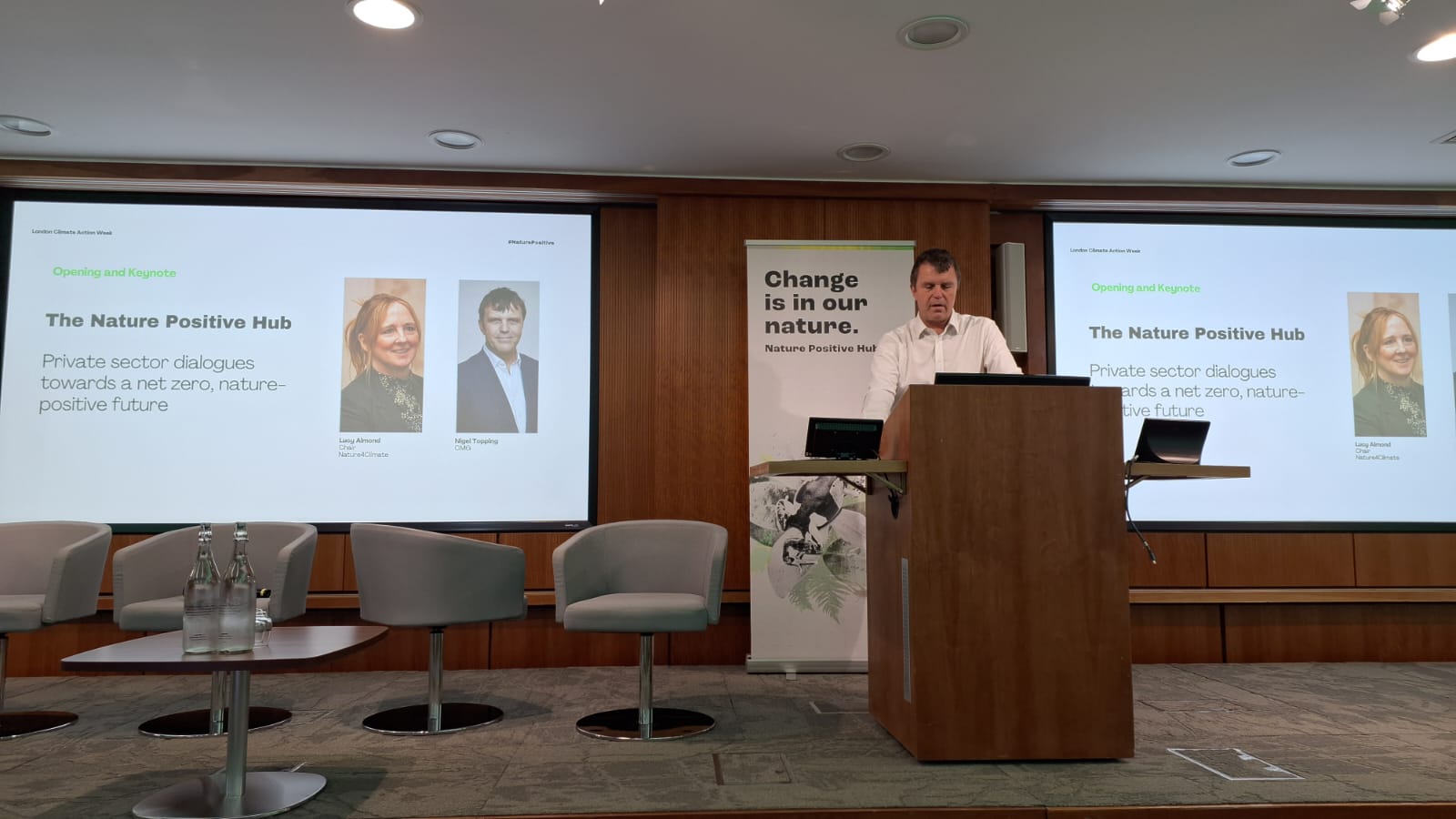

The event was part of the Nature Positive Hub at London Climate Action Week. As a day-long event, the hub is a space for discussion and connection. Read the hub wrap-up and key takeaways here.

Below, we share our impressions from the hub’s opening and the first panel discussion, titled ‘Overcoming Hesitation About Investing in Nature-Based Carbon Credits’

Keynote with Nigel Topping

As the first session of the day at the Nature Positive Hub, the audience arrived with complimentary cups of coffee in hand. But any sense of sleepiness quickly evaporated as Nigel Topping took to the stage to deliver his keynote speech.

Surprisingly, the former UN Climate Change High-Level Champion for COP26 spoke about eggs. Using this analogy, he observed that we do not want to invest in the egg industry when we buy a half-dozen box; we just want to make a simple transaction.

This, he said, is where the nature-based credit market grows confused. At times, potential buyers need to act as investors to help nature-based carbon credit projects scale and grow.

But this is just one of three ‘cognitive traps’ Nigel Topping highlighted. First, he explained that the market is too focused on risk and compliance, leaving limited capacity for talented stakeholders to work on solutions.

Second, he discussed how carbon markets are not broadly understood to mean climate finance, meaning that it is not appropriately valued as a funding tool for poorer countries and communities already impacted by the climate crisis.With biodiversity loss classed by the Global Risks Report 2024 as the third most severe long-term risk facing humanity, Nigel Topping urged the room to approach nature-based solutions with pragmatism. Yes, nature is in itself a climate solution, but so too are private capital providers. Their cheque books can finance the conservation and restoration urgently needed for climate and nature.

The former UN Climate Change High-Level Champion for COP26, Nigel Topping. Photo: Mariana Ceccon/Nature4Climate

Why do companies hesitate over nature-based solutions?

- Lack of certainty;

- Merged or undefined roles; and

- A fear of risk.

Giulia Carbone was joined by Meta, EDF Trading, Salesforce, Climate Asset Management and Bain & Company, the first platinum claim under the VCMI’s Claims Code of Practice.

Several of these expert panellists said they found it relatively easy to win support for nature-based projects internally due to a widespread understanding of nature and climate. Nevertheless, there remained some causes for hesitation.

Lack of certainty

Panellists explained that a lack of certainty is one cause of hesitation. They said that without a clear guide as to what will count credit-wise towards future claims, it is difficult to include them in a long-term net-zero strategy.

What claims will be possible from nature-based credits? What will be the state of the market in 2030? And without stable answers to these questions, they said it is easy to think: “Why buy now?”

Eligibility uncertainty drives buyers and investors toward the most probable project types. Presently, this has created a preference for removals over avoidance or reduction projects among many of the panellists’ companies.

However, as one panellist pointed out, this is not because these projects are more impactful – it is always better to stop a tree from being cut than to plant a new one – but because there is greater confidence that these projects will count towards their net-zero targets in 2030.

Merging roles

Panellists explained that they often ask themselves what their role should be in the voluntary carbon market. With new nature-based projects requiring injections of cash to get off the ground, potential buyers can sometimes find themselves cast instead as investors.

While many companies are actively looking to invest (more on that below), there are times when they are simply looking to buy, much like the box of eggs in Nigel Topping’s analogy. But if high-quality, desirable projects are searching for investors, it further limits the pool of nature-based projects from which a company can choose to work.

Fear of risk

As a relatively new asset class, many corporates still fear the risks of working with nature-based carbon credits. This hesitation was not helped by the media criticism of 2023 with many companies delaying engagement.

One panellist explained that because risk does exist in the voluntary carbon market, it is vital to be proactive and humble. Best practice will evolve and change and companies need to keep up.

Giulia Carbone (WBCSD) was joined by Meta, EDF Trading, Salesforce, Climate Asset Management and Bain & Company. Photo: Mariana Ceccon/Nature4Climate

How can hesitation be overcome?

- Control and involvement;

- Positive communication; and

- Coalitions and market developments.

Control and involvement

To deal with uncertainty, panellists described an emerging trend: Companies increasingly wish to be involved in the design and implementation of nature-based projects to ensure quality.

Many see greater control of procurement as a viable route to securing a reliable stream of high-quality credits. This also speaks to their fears of reputational risk.

For already operational projects, companies overcome hesitation with careful due diligence. Many corporates run in-house due diligence on nature-based projects, paying close attention to the developer’s credentials and track record.

Positive communication

Panellists agreed that many high-quality, nature-based projects exist and that companies are buying and investing. However, with media headlines tending to focus on the negative, these stories remain unheard.

To fight hesitation, companies need to be bold. Those with positive, impactful experiences working with nature-based credits should speak out. Both as examples of best practice and to clarify the role carbon revenue as climate finance to poorer or developing countries.

Coalitions and market development

Coalitions, such as LEAF and Symbiosis, can help companies to overcome hesitation. In working together companies can collaborate to improve their understanding of nature-based carbon credits. It was agreed we need more like this.

There is also optimism for the future. The ICVCM is clearly defining a threshold for high integrity with its Core Carbon Principles which will help corporates buy or invest with confidence. The VCMI’s Claims Code of Practice will further support corporates as they add carbon credits, including nature-based, to their net-zero strategies.

The SBTi has opened the door to discussion on the use of carbon credits to meet Scope 3 emission reduction targets. Such a change would not only reward companies for action along their value chains but would bring clarity to corporates as to what will count or not going forward.

The Nature Positive Hub was hosted under the Chatham House Rules. We would like to thank our sponsors Global Canopy, Space Intelligence, Cultivo, Craigmore, Calculus Carbon and TIG for supporting the Nature Positive Hub.

READ MORE:

- Nature finance: not quite as sure as ‘eggs is eggs’Venture capital funding in nature tech startups increased by 18% in 2023

- Transitioning to nature positive portfolios: it can be done!

- After COP28, 46% of Nature Commitments Remain Stagnant

- Nature4Climate Nature Finance Survey Reveals Key NbS Investments for 2024